Despite a new prime minister and growing economic pressures, Ethiopia seems unlikely to seize the opportunity to open up its financial sector and lure more foreign investment.

By William Davison (Euromoney)

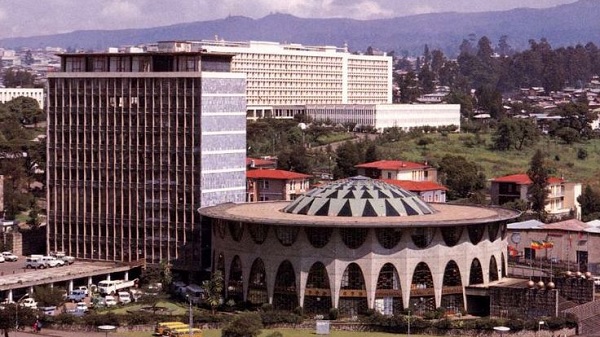

When members of Ethiopia’s banking and business community gathered in the glitzy Sheraton Addis for an audience with the reform-minded new prime minister, Abiy Ahmed, in the middle of April, any hopes for an opening up of the financial sector were dashed: they were told there would be no liberalization of the banking sector, which bars foreign ownership, according to Reuters.

The president, who has a mainly ceremonial role, reiterated Abiy’s message a week later, while Abiy’s predecessor, Hailemariam Desalegn, who did offer some fresh thinking, then corroborated the new prime minister’s message further in an interview with Bloomberg.

Ethiopia’s economy has expanded at an enviable clip; growth was estimated at 10.9% in the 2016/17 financial year, and averaged just over 10% a year from 2005/06 to 2015/16, according to the World Bank, compared to a regional average of 5.4%. But much of that dynamism has been in the public sector. Domestic and foreign state-owned banks, often Chinese, have funded transport links and power plants, while multilateral lenders have sunk cash into education, health, water and agriculture.

RELATED: Agriculture Fast Track Fund to accelerate agri-business development in Ethiopia

Sustained growth occurred while the government ran one of Africa’s most protected economies. As well as the closed banking sector, state-owned enterprises monopolize or dominate telecommunications, energy, and transport.

The relative success without deregulation means that despite political changes, Africa’s biggest lenders, which have established representative offices in Addis Ababa, will most likely have to wait to start commercial operations. “I don’t expect a big bang liberalization at any point soon,” says Nebil Kellow, an Ethiopian financial analyst and managing partner of FirstConsult.

Read the complete story at Euromoney magazine